As attention data evolves, attention segmentation can revolutionise targeting strategies. This approach considers both active and passive attention, catering to brands at different stages of growth and provides a baseline by which other data can be overlaid, explains in this WARC Attention Applied article by Dr Karen Nelson-Field, Founder and CEO, Amplified Intelligence.

Part 1: We need to connect the dots between attention measurement and brand growth

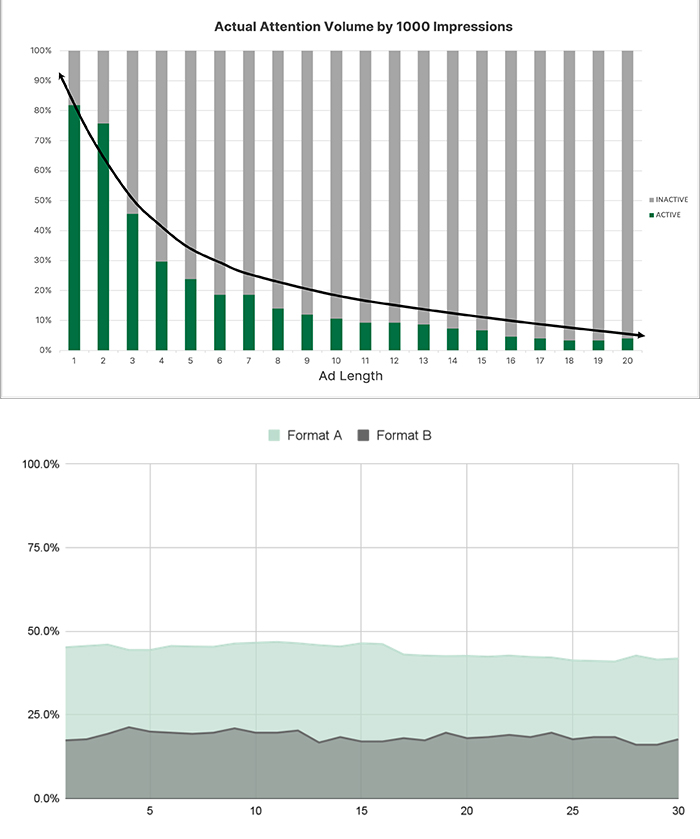

If we were to summarise the most important factors in the successful use of attention metrics, they would be ‘Attention Decay’ and ‘Attentive Volume’. Attention Decay refers to how quickly attention diminishes, while Attentive Volume represents the number of people paying attention across time. Combined, these represent: attention focus + attentive reach x time / attention type (active/passive/non-attention).

The variation in these two straightforward human viewing distributions is responsible for the vast majority of the variation in outcomes. Additionally, these distributions enable us to predict the potential attention amplification achievable with other triggers such as emotive creative or contextual placement. Understanding how these two distributions are connected to media formats is quite literally the golden key to unlocking highly successful attention products. Products that don’t consider these ‘blueprints’ of human attention behaviour will exhibit significant variability in their success for brands, with optimization recommendations frequently missing the mark.

But there is more to this story here. There is a deeper level of advertising effectiveness sitting under these distributions that the industry is yet to mine.

Beneath the surface here lies a layer of nuance, largely driven by the effects of brand size. So to maximise the true value of attention data, understanding how advertising works, and how brands can grow, is key. For example, big brands with a brand maintenance campaign will have different attention requirements (i.e. focus, attentive reach, time and attention type) than smaller brands trying to establish themselves in the market who wish to drive greater levels of buyer penetration. And campaigns aiming to drive mental availability will require different attention requirements but this will also depend on the size of your brand.

As we continue to learn about how human attention can work at scale, these types of findings show us why a ‘one-size-fits-all’ approach to attention metrics that consider high/low quality/scores or time does not work particularly efficiently. To get the most from attention data we need solutions that offer a tailored approach to campaign requirements. But this has the potential to be complex, and we’re aware that the industry prefers straightforward solutions without the need for an in-depth understanding of the technical details.

So, how can we accomplish both goals? How can we maximise the value of attention data in a precise manner while also simplifying the complexities involved?

Easy, let’s go back to the future.

Fig. 1 Attention Decay and Attention Volume

Part 2: Reintroducing traditional audience segmentation with a new twist

Audience segmentation has always been a principal way for brands to match their media buy to their target audience. Until the middle to late 90’s audience matching was ‘indirect’ where the best available proxy for product usage was demographics. Ultimately, demographics was found to be a poor proxy for future brand choice (even in my own PhD research), but demographics collected via scaled surveys were the only human data connected to (claimed) media use at the time. Then the programmatic era began and panel-based demographic buying saw its biggest challenger in three decades. The world wide web brought a more precise process of ‘direct’ matching where the same respondents could be tracked automatically by their actual media exposure and product usage. In this era, demographics took a back seat to individual-level behavioural segmentation such as interest, affinity or attitudes, rather than the less informative age and gender criteria.

What we know now of course is that this era also brought unparalleled (and invasive) surveillance capitalism laced with high degrees of wastage (even with validated viewability and attribution). It also saw marketers over-segment audiences, create a short-termism mindset and we lost control of the value of CPM (see Section 2.2 called Cost Per Meaningless Thousand in my new book ‘The Attention Economy: A Category Blueprint’. Springer Nature). Despite all this, on a positive note, this era did allow advertisers to better understand, organise, activate and measure their first-party data giving them experience with data ecosystems. All of which is good training for the ‘now’ – an era post cookie where the functionality of tracking and activating audiences needs to radically change. Where the data we collect and use for targeting needs to move from personally identifiable touch points, to a less invasive collection of data related to media consumption and media placement with no connection to the specific individual, their preferences or subsequent online activities.

Part 3: Attention segmentation as the foundation for targeting strategies

All in all, attribution cookies and attention data both gauge the effectiveness of online advertising, but they do so in different ways. But here is the ‘back to the future’ part. Recognising the importance of privacy-safe attention data and its proven value in advertising effectiveness, there’s a compelling opportunity to reintroduce segmentation techniques reminiscent of the pre-cookie era. If we can develop a robust yet simple framework that accommodates various campaign objectives, attention segmentation could serve as a foundation for brands to customise their segmentation plans with attention data and layer in their own as required.

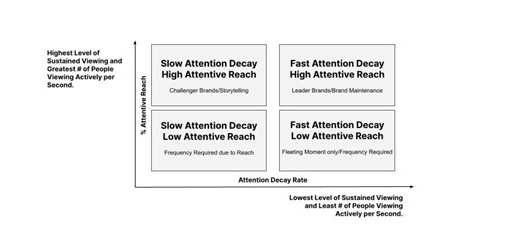

Instead of oversimplifying with distinctions like high/low quality, we constructed a framework based on a continuum of the two critical factors mentioned previously: ‘Attention Decay’ and ‘Attentive Volume’ distributions. These factors form the ideal axes for a framework rooted in the principles of brand growth. Each ad format (including ad length) was plotted against ‘decay rate’ on the X-axis and ‘volume’ on the Y-axis.

In its simplest form, the model generates quadrants for ‘easy to apply’ media recommendations relative to typical big/small brands and growth/maintenance campaign requirements. For example, formats falling in the upper left quadrant (Segment 1) are more effective for challenger brands due to sustained attention and higher attentive reach. Conversely, Segment 3, while also featuring sustained attention, lacks attentive reach, making it less suitable for challenger brands needing greater exposure for longer periods, especially to non and light buyers. In its more advanced form, the axes are dynamic, allowing for customization based on specific brand needs, such as requiring higher levels of sustained viewing for storytelling around a new variant.

So far we’ve tested the framework across $92 million in ad spend, spanning 13 months of data, 54,000 campaign line items, and 10 countries all with outcomes data. As expected, the strongest relationships between ad spend and desired outcomes occur when the appropriate amount of money is invested in specific segments based on the specific needs or objectives of the campaign with considerations of brand penetration. This implies that understanding the campaign requirements and allocating resources accordingly leads to more effective outcomes.

This work also enabled us to analyse ‘Share of Attention’ by Segment by competitor; a term Peter Field regularly mentions as an alternative to failing Share of Voice metrics in the market.

Fig 2. Simplified Version of Attention Segmentation

Summary

As attention data evolves, attention segmentation emerges as a solution to revolutionise targeting strategies. This transformative approach considers both active and passive attention, catering to brands at different stages of growth, and provides a baseline by which other data can be overlaid.

This future-facing solution addresses the crucial question of ‘how much attention is enough?’ while plugging effectiveness gaps in aggregated metrics that don’t take into account how advertising works and how brands grow.

Now is the time to go ‘Back to the Future’ with an approach that simplifies complex human behaviour, while giving us a robust solution post-cookie. A win-win-win for Marty McFly and Doc Brown.

The best-selling hit of 2020 that was “The Attention Economy, How Media Works” was a groundbreaking book by Dr. Karen Nelson-Field, helping reshape media measurement by introducing attention measurement as a pivotal method for brands and agencies worldwide. Her latest book, “The Attention Economy, A Category Blueprint,” builds on this foundation, offering in-depth research, insights, frameworks, and predictions for the future of human-led media measurement. Dr. Nelson-Field, a leading media science researcher and CEO of Amplified Intelligence, has been instrumental in transforming media measurement globally, advising major agencies and brands, and building innovative solutions in omnichannel attention measurement.

This article is published with permission of WARC. You can read the original in full here and discover a wealth of other industry leading insights on their website.